Keywords: Global Financial Crisis

There are more than 200 results, only the first 200 are displayed here.

-

ECONOMICS

The question that should be posed is how effective has the Reserve Bank been at ‘managing’ the economy and financial system? ‘Not very’, has to be the answer. Not that the RBA is alone. The same pattern has been seen across the developed world. Central banks have one weapon at their disposal, the cost of money (the interest rate), and there is not much evidence they have used this tool to make their systems sustainable. Mostly, they have made matters worse.

READ MORE

-

ECONOMICS

As commodity prices and inflation soar in the ‘real’ world we may be witnessing a prelude to another 2008-style crisis triggered by the foreign exchange markets. The risks certainly look similar and can be described with a simple question. Can the fictions produced by out-of-control financial actors survive reality?

READ MORE

-

ECONOMICS

- Julian Butler

- 31 March 2022

1 Comment

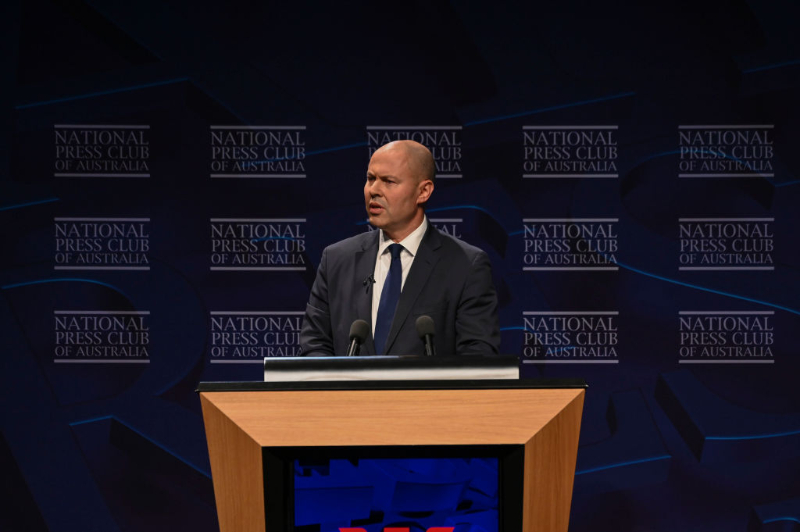

In 2020 as the Covid-19 pandemic raged globally, as Australia shut its borders and some states shut in their people, massive government income support was introduced. The government was a little slow coming to recognise the need for such measures. Once they had, they wanted the support rolled out as quickly as possible. Frydenberg, Scott Morrison and their colleagues recognised that a demand side boost was absolutely necessary to sustain economic activity. The government was uncomfortable, though, with this approach.

READ MORE

-

ECONOMICS

- David James

- 01 March 2022

3 Comments

Australia’s Reserve Bank mainly concentrates on keeping inflation within an acceptable range and maintaining a high level of employment. Social equity has never been considered to be part of its mandate. It should be. Interest rates have been the biggest cause of economic and social division in Australia, not just between rich and poor, but also between older and younger generations.

READ MORE

-

ARTS AND CULTURE

- Barry Gittins

- 14 January 2022

4 Comments

We’ve been in a pressure cooker, these past two years. More than a score of historians had memorably described 2020 as the sixth-most ‘stressful year ever’. Predictions and speculations look ahead; I looked at the past trends of the past two years and make these humble observations. With the stage set for dire times, here are six trends to look for in 2022. Here’s hoping.

READ MORE

-

ECONOMICS

- David James

- 06 December 2021

4 Comments

If Australia does draw back from globalisation — as opposed to trade, which will continue — then there should be more focus on our primary sector and how it could be better financed. Australia’s long history as a primary producer constitutes what economists call a ‘comparative advantage’: an economic area in which a country does best while giving up the least.

READ MORE

-

ECONOMICS

- David James

- 08 November 2021

4 Comments

The Glasgow United Nations Climate Change Conference has been advertised as an effort to focus on sustainable environmental solutions. What got much less attention, if any, is that it is probably at least as much about having a sustainable financial system. Many noted that China, did not send its leader: Xi Jinping, president of the world’s greatest CO2 emitter. There was also another significant absence: the financiers who are hoping to profit from the trillions allocated into climate change projects.

READ MORE

-

ECONOMICS

- David James

- 12 October 2021

4 Comments

Over the last two years, money printing has created the illusion of strength in savings. But when reality resurfaces, and actual returns are required from actual economic and business activity, the global financial system will come under extreme stress.

READ MORE

-

ECONOMICS

- David James

- 12 August 2021

4 Comments

The biggest mystery of the financial markets is why, when the monetary authorities have been printing money with their ears pinned back, is inflation for the most part not a problem? What happens with inflation is crucial to the short-term survival of the whole system. Global debt, which is running at well over 300 per cent of global GDP, is only sustainable because interest rates are exceptionally low (the base rate in Australia is only 0.1 per cent). And interest rates are low because inflation is not a problem.

READ MORE

-

ECONOMICS

An often overlooked fact about the financial system is that it entirely depends on trust. When trust starts to evaporate, especially between the big players such as banks and insurance companies, the whole artifice is put into peril. Trust in the system is now at an extreme low and that points to extreme danger.

READ MORE

-

ECONOMICS

But although the Coalition will never admit it, it looks suspiciously like there has been some bipartisan institutional learning about how to manage financial crises. If you want to stimulate an economy in times of crisis put the money directly into the economy, either into people’s pockets or to businesses who then pass it on to workers.

READ MORE

-

ECONOMICS

- David James

- 10 December 2020

1 Comment

The world’s financial markets are afflicted by a deep irrationality that imperils their very existence. On the surface, finance looks logical enough with its numbers, charts, mathematics, forecasts, ‘modelling’ and so on. But this only masks the fact that the system itself has been working on underlying assumptions that are either contradictory — such as that you can ‘deregulate’ finance when finance consists of rules — narrow minded or absurd.

READ MORE